Meet BlueBean

We’re upgrading the checkout experience — so you stay compliant and naturally control every business purchase.

Why BlueBean?

Check out with BlueBean, save more and get the job done faster.

Fast and easy

Checkout on supplier sites with SSO — negotiated prices, no portal.

Better automation

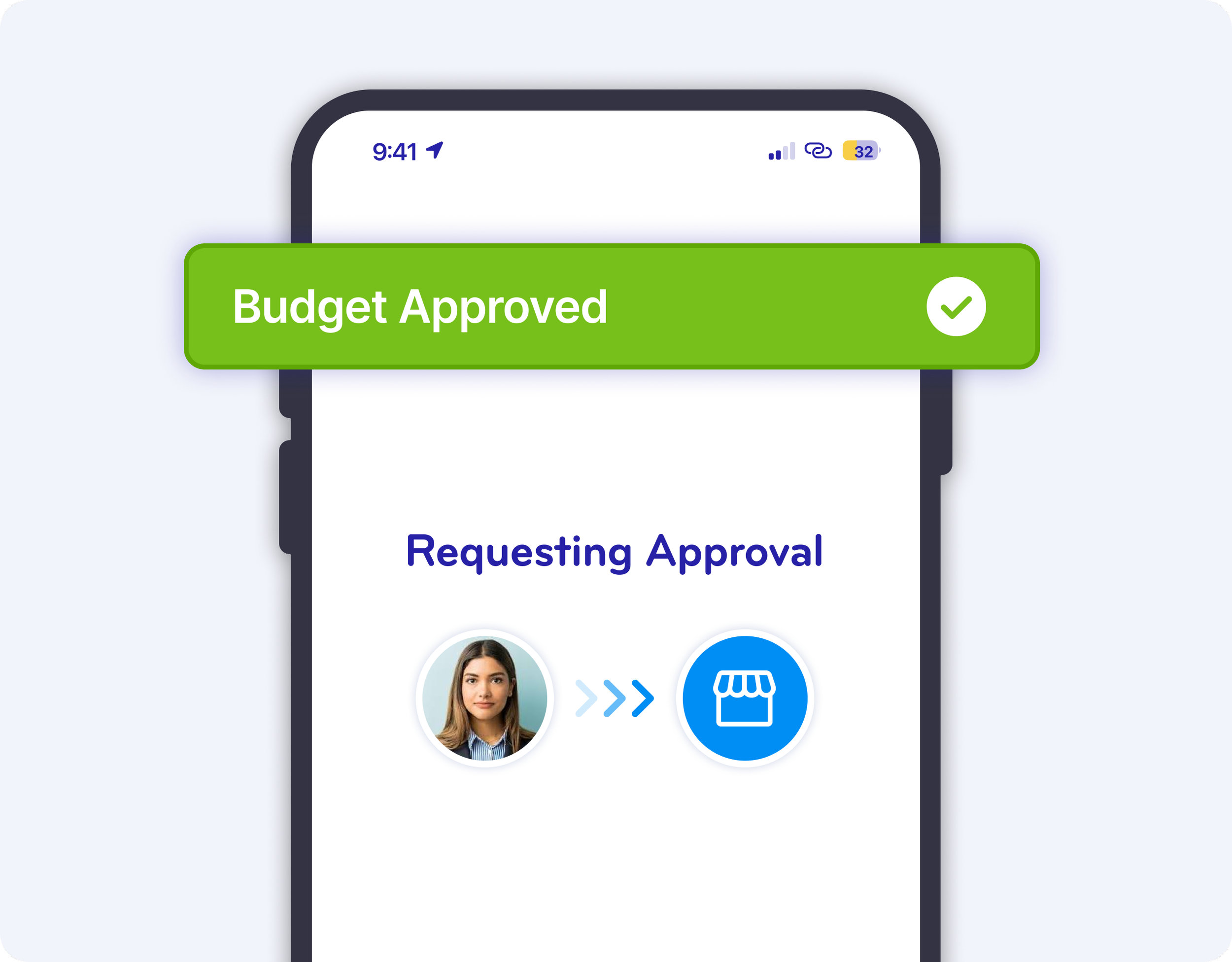

Automated approvals, payments, and accounting — no manual work.

More savings

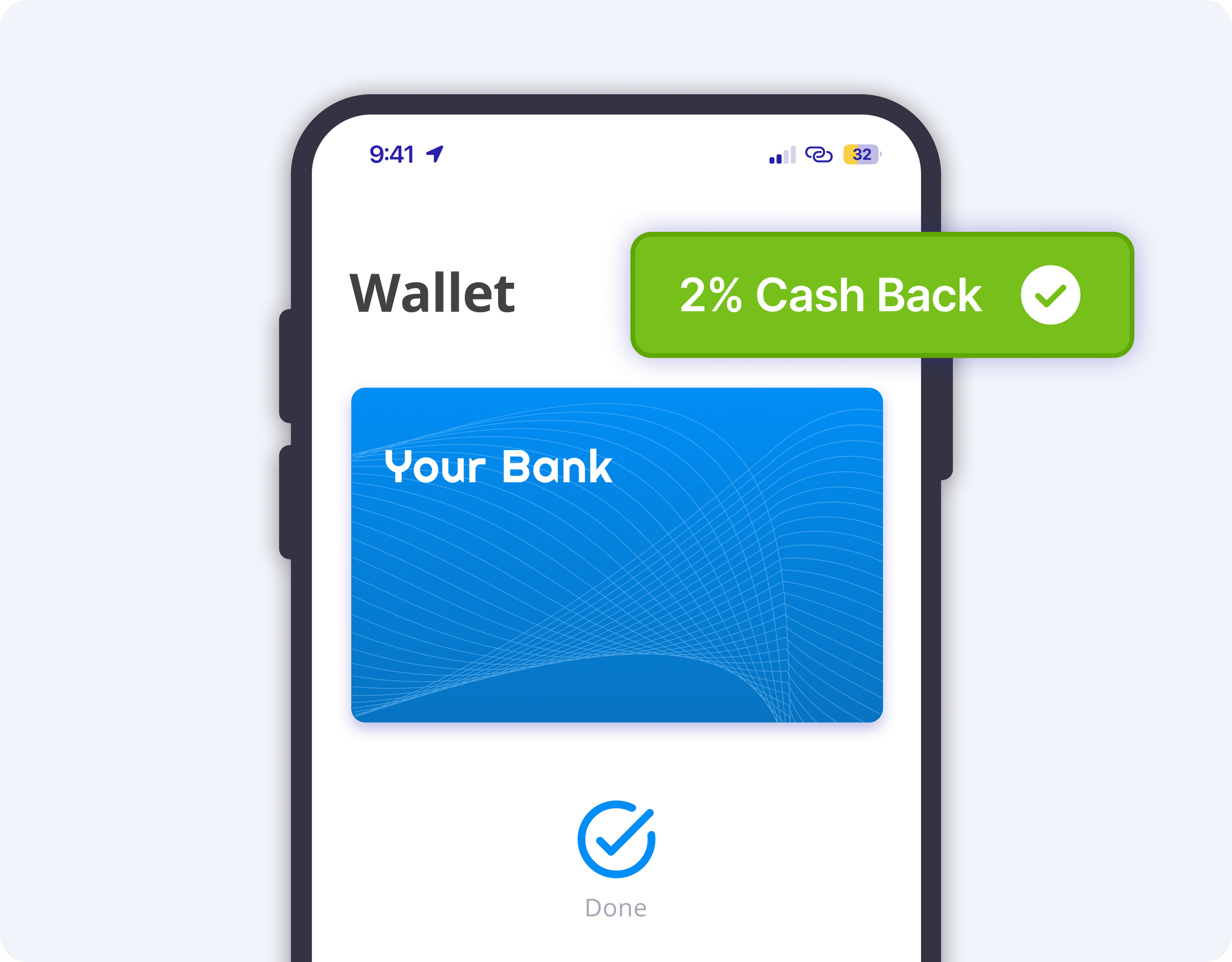

Employees pay with secure virtual cards — and you earn a rebate on every purchase.

Learn how to use BlueBean

(in about a minute)

Setting up BlueBean is as easy as 1 - 2 - Click!

Connect your eligible business or corporate card account.

Set up your controls and invite your employees.

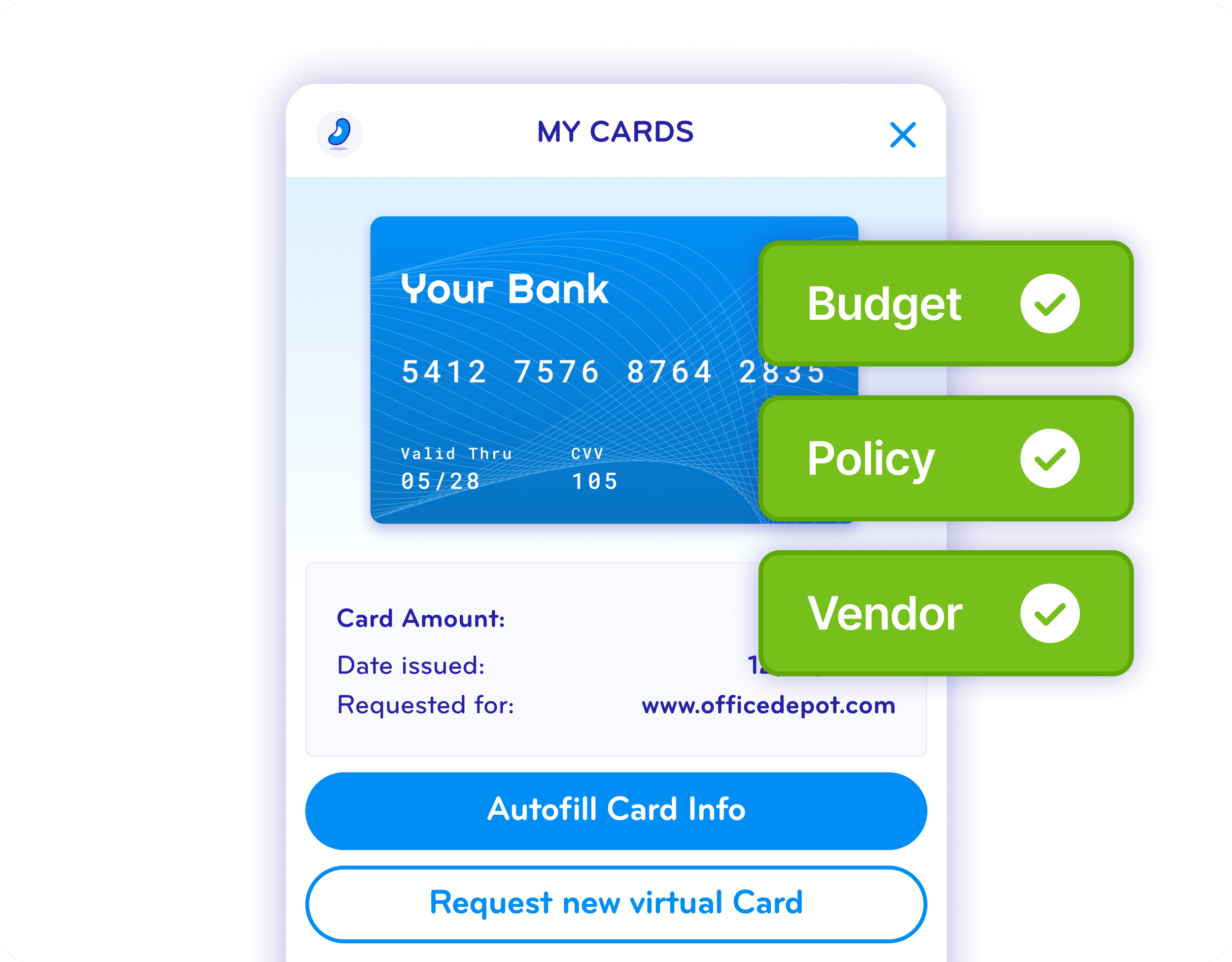

Click to pay with complete control at every online check out.

Any questions?

Which banks work with BlueBean to issue virtual cards?

We are excited to announce new card issuers coming Q1 2026

Built for Every Part of Your Business —

From Employees to Finance to Procurement

Tail Spend

Start small with ad-hoc purchases and team expenses

Expense Automation

Scale to full expense management with receipt matching

Total Spend Management

Control all company spend with procurement and cards

Get Started with BlueBean — and Turn Every Dollar into Value

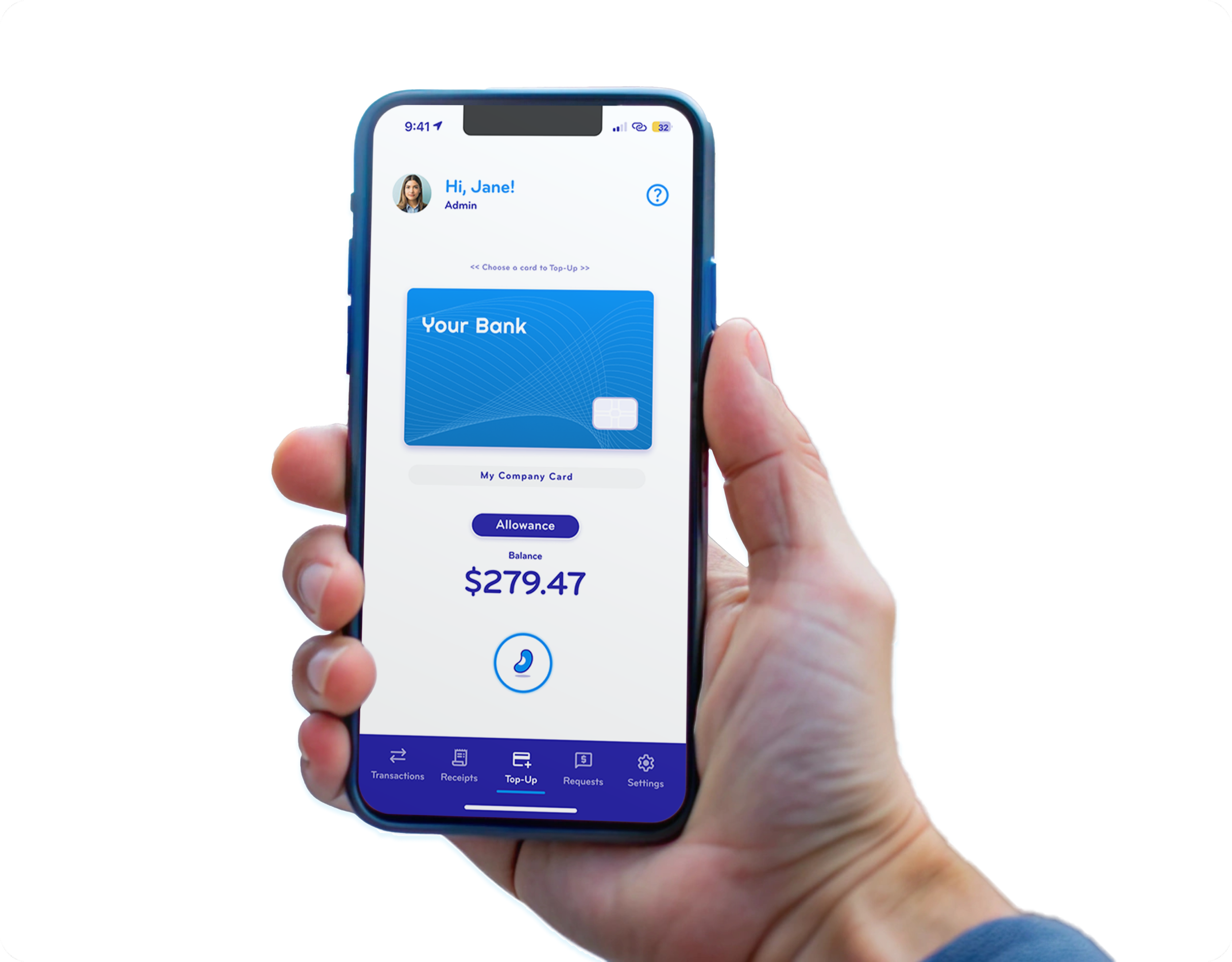

For In-Store Purchases

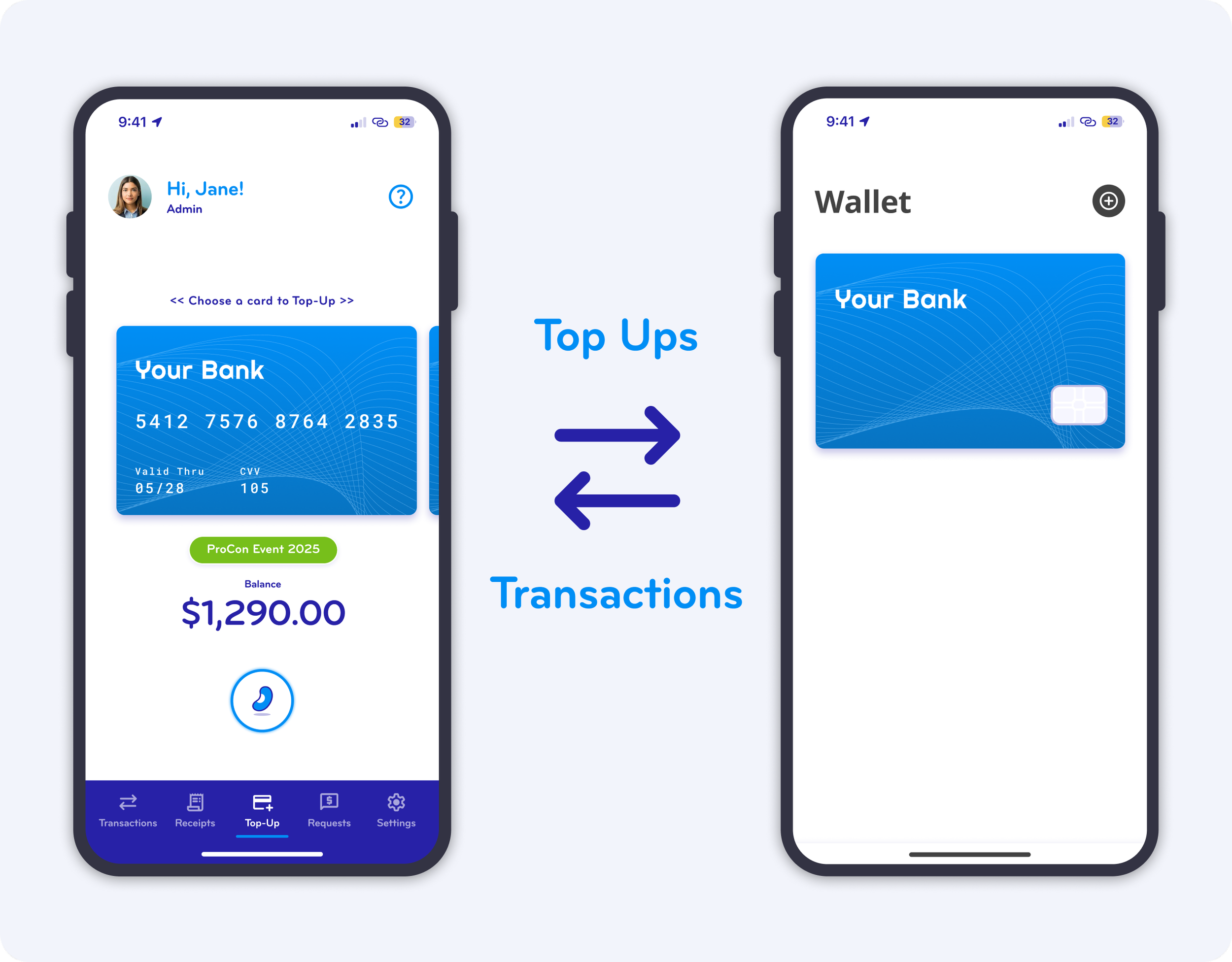

Virtual cards issued on BlueBean work with your digital wallets.

The BlueBean mobile app seamlessly helps you manage your expenses on the go: automated expense reports, receipt capture and accounting.

What is BlueBean?

BlueBean is the first card-native, AI-controlled spend and expense management platform that embeds finance directly into every business checkout — online and in-store. By connecting card issuance, approvals, and accounting logic at the point of payment, BlueBean ensures every transaction is controlled before it happens and captured automatically after it completes.

Employees pay the same way they do as consumers — by tapping or clicking — while finance and procurement teams retain real-time visibility, enforced policies, and automated accounting across all spending.

One platform that scales from expenses to full spend management

Organizations can start with BlueBean by automating expense tracking and receipt capture for existing cards. From there, they can expand to issuing secure virtual cards with embedded controls for online and in-store purchases, and ultimately manage all company spending through a single, card-native platform.

This progressive approach allows teams to scale without changing tools or retraining employees. Whether managing day-to-day expenses or company-wide purchasing, BlueBean provides a consistent foundation for controlling, paying, and accounting for every transaction.

Why BlueBean is different from traditional spend management platforms

Traditional spend and expense management platforms rely on portals, catalogs, reimbursements, and invoice workflows to control spending. These models introduce friction, delay purchasing, and create operational overhead for employees, procurement, and finance teams.

BlueBean replaces portals and invoice payments with embedded finance. Controls, approvals, and payments are executed directly at checkout using card-native technology. The result is faster purchasing, stronger compliance, reduced accounting workload, and a fundamentally simpler way to manage business spend.

Join the Companies Turning Spend Into Savings with BlueBean

Companies of all sizes use BlueBean to control spending, automate accounting, and earn rebates on every dollar spent.

Chris Skinner

VP Research & Development, Cognitus

“We use BlueBean to make employee expenditures easier to manage. When someone needs to book a flight or buy office supplies, BlueBean not only gives them access to a virtual card to make the purchase, but automatically captures the receipt and related information, saving them the time and hassle of submitting an expense report.“

Teagan Clare

Lab. Technician, Safety Officer, ExocelBio

“With BlueBean, getting virtual cards approved at check out and capturing receipts for buying lab supplies is so simple. The auto-approval keeps spending in check and manual approval is only needed for exception purchases. By using their marketplace we were able to save 10% from what we used to pay.”

Eric George

Co-Founder and CEO, Blu Buying Club

“I was blown away by the Blue Bean extension. It only took 10 minutes to learn, and it is incredibly easy to use. The BlueBean solution has streamlined vendor management and simplified payments and accounting. It's intuitive and saves us valuable time, allowing us to focus on business growth and automate back office tasks.”

Ready to See BlueBean in Action?

2% Average Rebate

100% Automated

Instant Card Issuance