Expenses that Manage Themselves - Automated Expense Tracking for Business

Give your team a smarter way to track, review, and close expenses. BlueBean captures every transaction the moment it happens, applies your accounting rules automatically, and ensures each expense finishes fully documented and ready for your books.

Spend less time reviewing. Close faster. Stay fully compliant.

Put Accounting Rules on Auto-Pilot

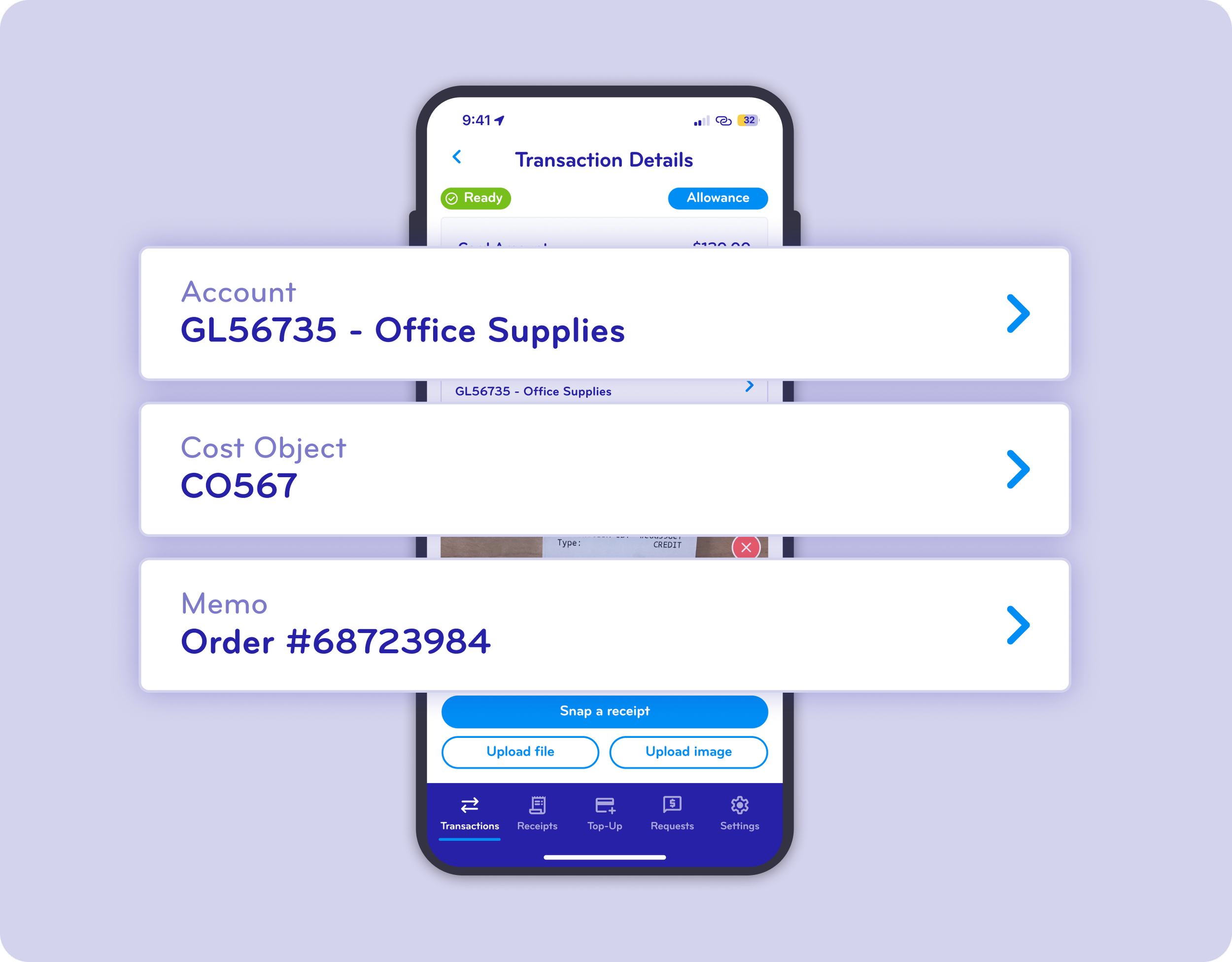

Stop relying on employees to remember accounting details. BlueBean automatically assigns the correct G/L account, cost center, project, or any cost object based on your preset policies.

Your rules. Applied instantly.

Auto-map transactions based on merchant, user, category, or amount

Build rules once—BlueBean handles every future expense

Eliminate manual errors and downstream cleanup

BlueBean keeps your data clean from day one.

Flag Anomalies Before They Hit Your Books

BlueBean catches issues the moment a charge appears—so finance doesn’t have to hunt them down later.

Auto-detection includes:

Missing receipts (based on amount or transaction pattern)

Potentially incorrect or mismatched receipts

Merchants or categories requiring itemization

One-time charges that should match recurring patterns

Any transaction needing extra review before approval

Your team reviews fewer transactions—and only the ones that truly need attention.

Itemize Every Expense with Ease

Complex expenses don’t have to slow your team down.

Employees and accountants can split a single charge across multiple accounts, cost objects, or customers with just a few clicks.

Flexible itemization supports:

Multi-account and multi–cost-object splits

Amount based allocation

Marking any line as billable to customers

Clear visibility for reviewers and accountants

Accuracy without the spreadsheet.

Track and Approve Expenses Anywhere

Whether your team is at the office, on the road, or checking out online, BlueBean keeps every transaction instantly accessible.

Available on:

Web App

Chrome Extension

Mobile App

Approve, correct, or complete expenses from any device. Workflows don’t wait for desktop.

Ensure Every Transaction Ends with a Completed Expense

With BlueBean, no transaction is left incomplete.

Receipts are attached, rules are applied, splits are itemized, and approvals are captured—every single time.

BlueBean guarantees:

Every purchase becomes a fully completed expense

Every policy is enforced

Every approval is auditable

Every line syncs cleanly into your accounting system

Better compliance. Faster close. Zero loose ends.

FAQ

-

BlueBean tracks expenses the moment a transaction happens, automatically applying your accounting rules, cost centers, and categories.

There is no need for employees to create expense reports — every purchase is logged, enriched, and classified instantly. -

BlueBean uses your company’s accounting rules to apply the correct:

general ledger account

cost center

object or project

tax rules

category

This classification happens in real time and follows the same logic finance would apply manually — but without human effort.

-

Yes.

BlueBean automatically flags anomalies, including:unexpected merchant behavior

out-of-pattern spend

incorrect amounts

duplicate charges

classification mismatches

These alerts surface issues early, reducing accounting effort and improving compliance.

-

Yes.

When a purchase needs to be itemized (for example, when part of the spend is billable or must be allocated differently), employees can quickly break it into items.

BlueBean then applies accounting rules to each item — ensuring precise allocation. -

Yes.

Employees and managers can manage expenses in the office or on the go, with full access to transactions and receipts.

This ensures expenses stay up to date in real time. -

Yes.

BlueBean’s philosophy is “expense completed for every transaction” — meaning:the transaction is captured

the receipt is attached

accounting rules are applied

anomalies are flagged

the item is ready for ledger posting

There is no backlog, no month-end scramble, and no dependency on employees submitting manual reports.

-

Because expenses are fully enriched at the moment of purchase, accounting teams no longer need to:

recode transactions

chase missing receipts

investigate misclassified expenses

wait for manual submissions

correct errors weeks later

This reduces operational workload and accelerates month-end closing.

-

Yes.

All enriched transactions appear instantly in the Expense Dashboard, giving finance teams granular visibility into:who is spending

what they are spending on

the correct accounting classification

anomalies that require review

No delays, no blind spots, no reconciliation surprises.

Start Automating Your Expense Tracking Today

Give your team the smartest, fastest way to handle expenses—from tap to books.