Move Faster. Stay in Control. Deliver More Value.

Operations runs on speed. But traditional purchasing processes and legacy expense tools slow teams down when they should be focused on delivering impact. BlueBean removes the friction—so Ops teams can operate with clarity, confidence, and immediate access to what they need.

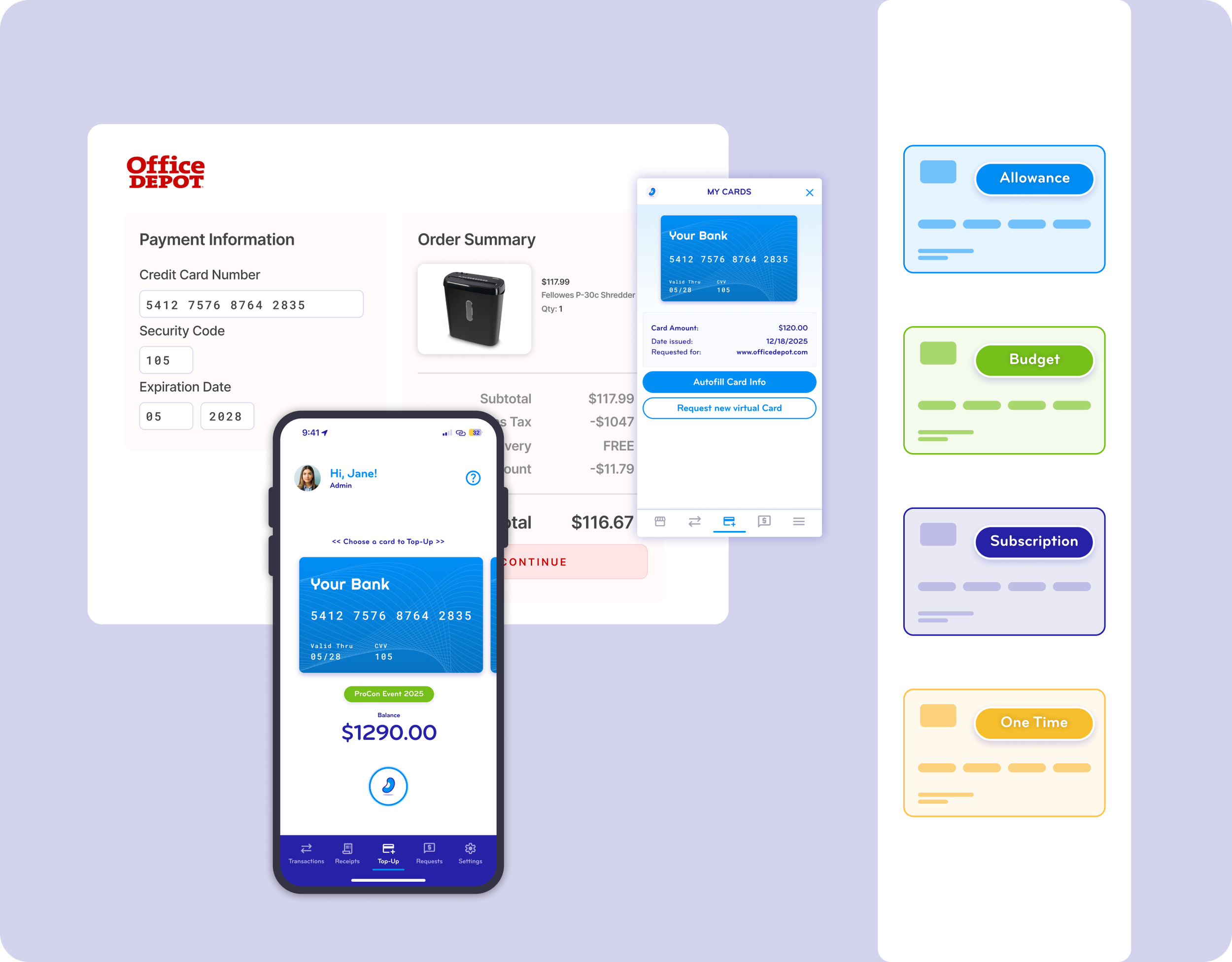

Instant virtual cards, automated guardrails, tap-to-pay expenses, and built-in compliance help your team work the way modern teams should: fast, flexible, and fully accountable.

Get Teams Running in Minutes, Not Weeks

Physical card programs and old procurement tools require long onboarding cycles and endless coordination. BlueBean makes it simple:

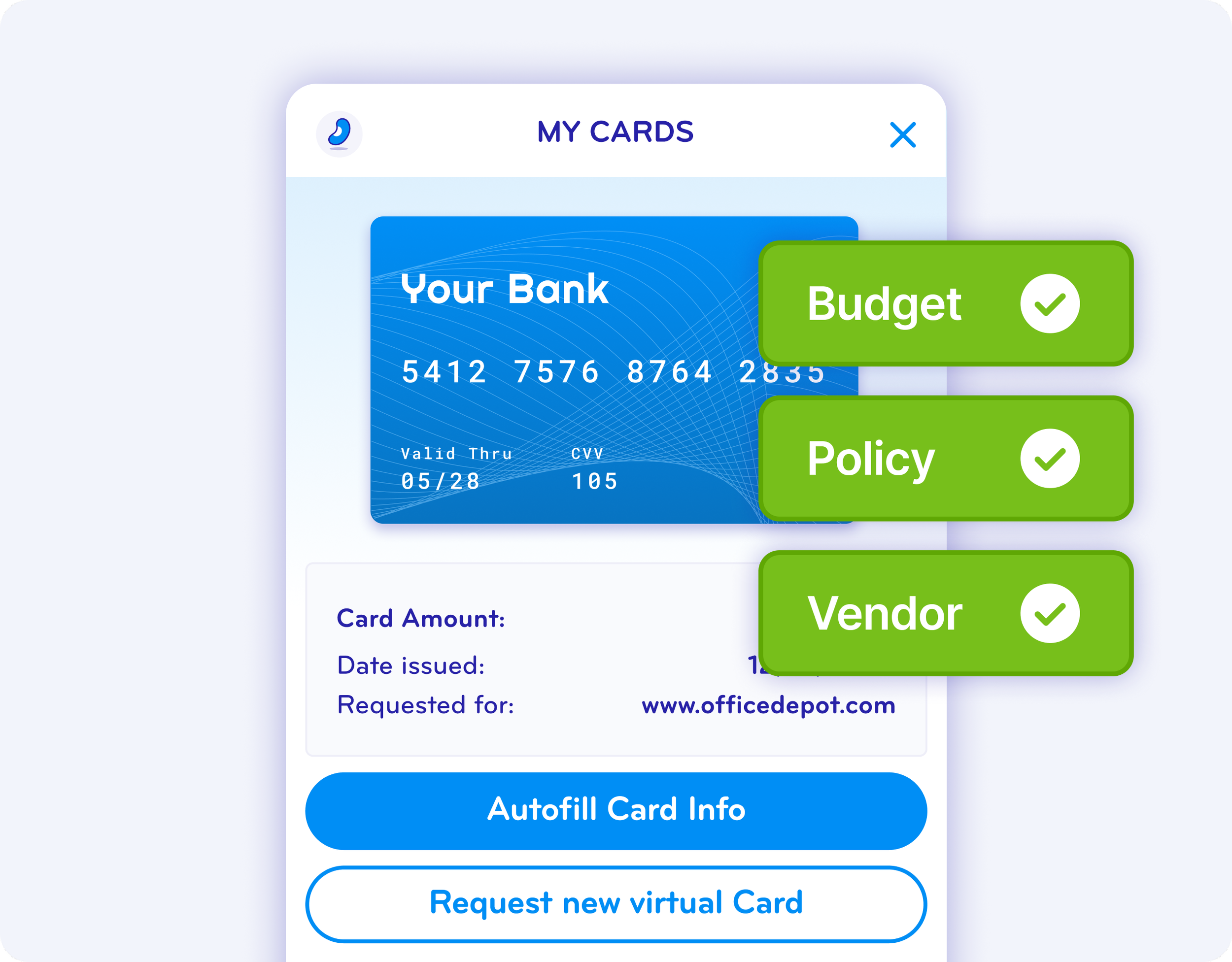

Issue virtual cards in seconds with pre-set controls

Onboard employees instantly—no tools to configure, no forms to chase

Offboard in one click with immediate removal of spend access

BlueBean becomes the fastest part of your Ops workflow, not a new bottleneck.

Goodbye Expense Reports. Hello Actual Work.

Ops teams shouldn’t spend hours documenting spend or tracking down missing receipts. With BlueBean:

Purchases are automatically categorized

Receipts are captured instantly after every payment

Policy rules are applied upfront, not retroactively

Approvals flow naturally in the background

Your team gets back time to do the work that actually moves the business forward.

Buy From Anywhere—With Full Policy Compliance

BlueBean turns purchasing into a simple, self-serve experience without sacrificing control.

Employees can buy from any supplier that fits your policy

Virtual cards ensure every transaction stays compliant

No more back-and-forth with suppliers on availability

Purchases that used to be “maverick” become governed by default

Ops teams move faster. Finance keeps full visibility. Everyone wins.

Effortless Chargebacks. Zero Reconciliation Headaches.

If your team needs to allocate spend across departments or bill customers, BlueBean makes it easy:

Each transaction is isolated, itemized, and traceable

Costs can be tagged by project, client, or team

Data exports are clean, complete, and audit-ready

Every receipt is automatically stored and linked

Chargebacks become a workflow—not a month-end project.

Why Operations Teams Choose BlueBean

Up and running instantly

Virtual cards that unlock spend, not slow it down

Clear guardrails that remove ambiguity and manual checks

A purchasing experience that mirrors how teams already work

Full visibility for Finance without Ops losing autonomy

Increase service level for clients

BlueBean gives Operations the power to move quickly and responsibly, without the heavy systems or long change management cycles.

See How Fast Ops Can Move With BlueBean

Walk through BlueBean with our team and see how modern spend management can power your operations.

Try BlueBean and see how quickly your team can operate when cards, approvals, and receipts just… work.