Finance & Accounting Teams: Automate Spend, Eliminate Manual Work, and Close the Books Faster

Finance and Accounting leaders are under pressure to enforce controls, maintain accuracy, and keep the business moving—without drowning in spreadsheets, paper receipts, or endless invoice processing.

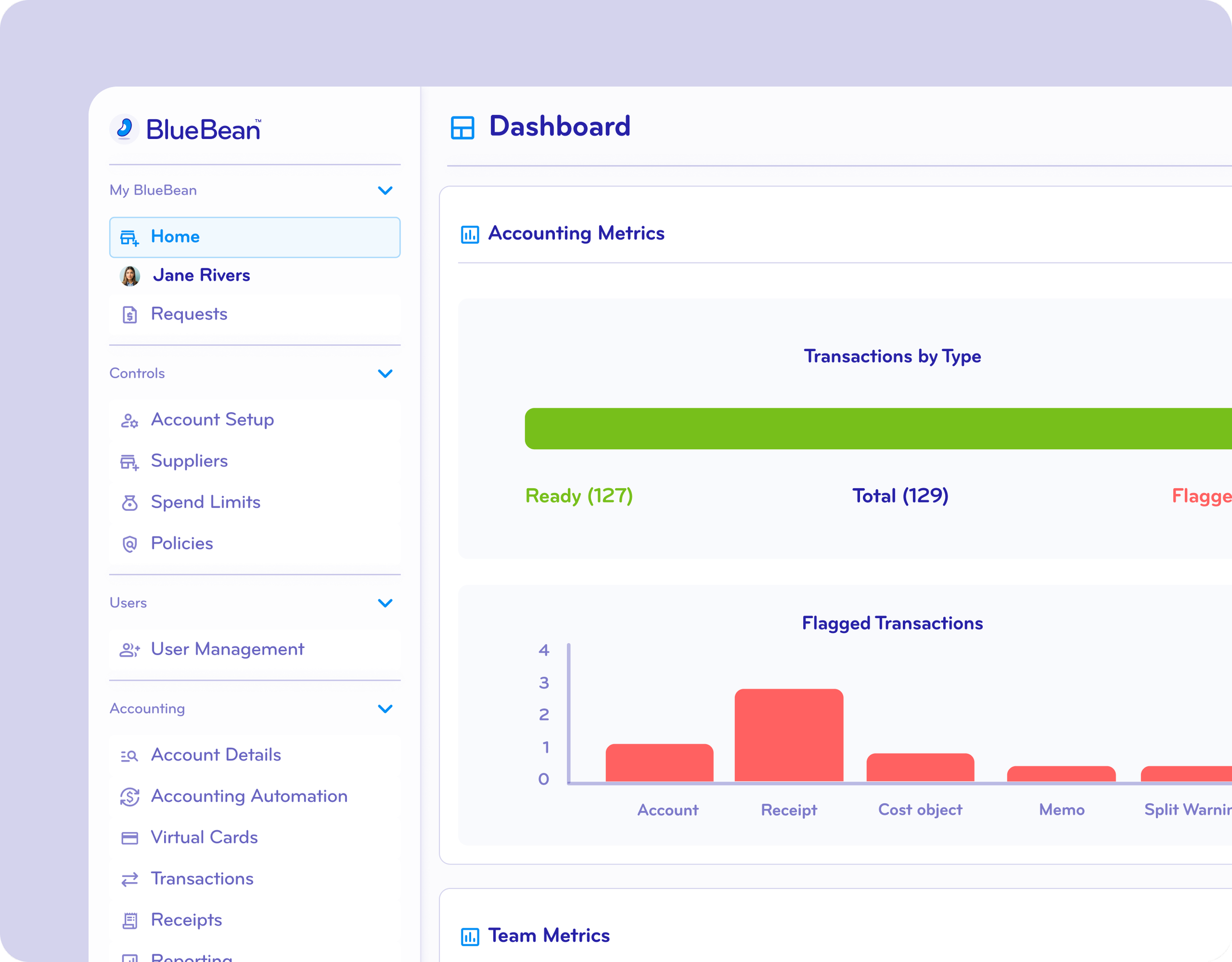

BlueBean brings automation to Expense Management, Procure-to-Pay, and Tail Spend, giving finance teams real-time visibility and fully compliant transactions from the moment money is spent.

Finally—No More Manual Processes

Traditional finance workflows rely on chasing receipts, reconciling spreadsheets, approving spend twice, and keying invoices by hand. BlueBean replaces all of that with instant, automated, audit-ready digital data.

With BlueBean you eliminate:

❌ Manual spreadsheets

❌ Paper receipts and small invoices

❌ Double approvals

❌ Manual data entry into your accounting system

❌ Endless chasing and follow-ups

And you gain a seamless, automated flow of spend data that closes the books faster—every month.

Automated, Pre-Approved Spending That Hits the Books Cleanly

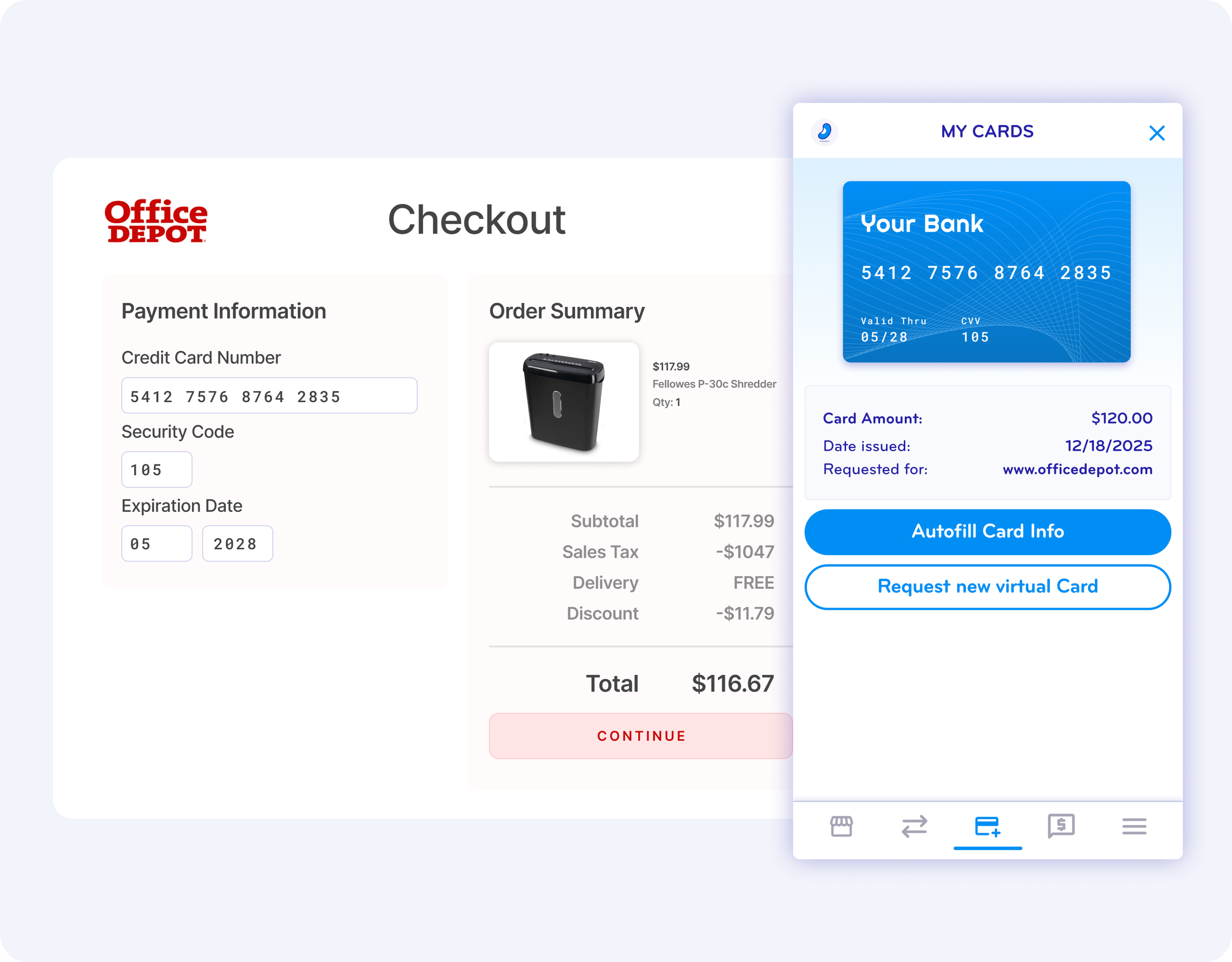

BlueBean lets teams set rules and controls in advance. Once activated, every purchase made with a BlueBean virtual card automatically follows those rules—no human intervention required.

How it Works:

Pre-approved virtual cards ensure spend is compliant before money leaves the company.

Once a purchase is made, the transaction is instantly tagged, coded, and categorized.

The transaction flows into your accounting system fully prepared—no second approval needed.

This means finance teams spend less time approving, reviewing, and correcting data—and more time on strategic work.

Receipts, Invoices, and Justification—Captured Automatically

BlueBean captures every supporting document automatically the moment a purchase happens.

Automatic documentation includes:

Real-time capture of receipts and invoices, both online and at point-of-sale.

Automatic sync with accounting systems.

Rules-based requirements for notes, GL codes, cost centers, project tags, and more.

Everything is collected instantly—before an employee forgets, and before Finance has to chase them.

Spending Reports Generated Automatically

Using transaction data + captured documentation, BlueBean automatically produces audit-ready spending reports.

No more building reports manually

No more asking departments for updates

No more missing information

Finance teams get complete, real-time visibility—ready for close, audit, or analysis.

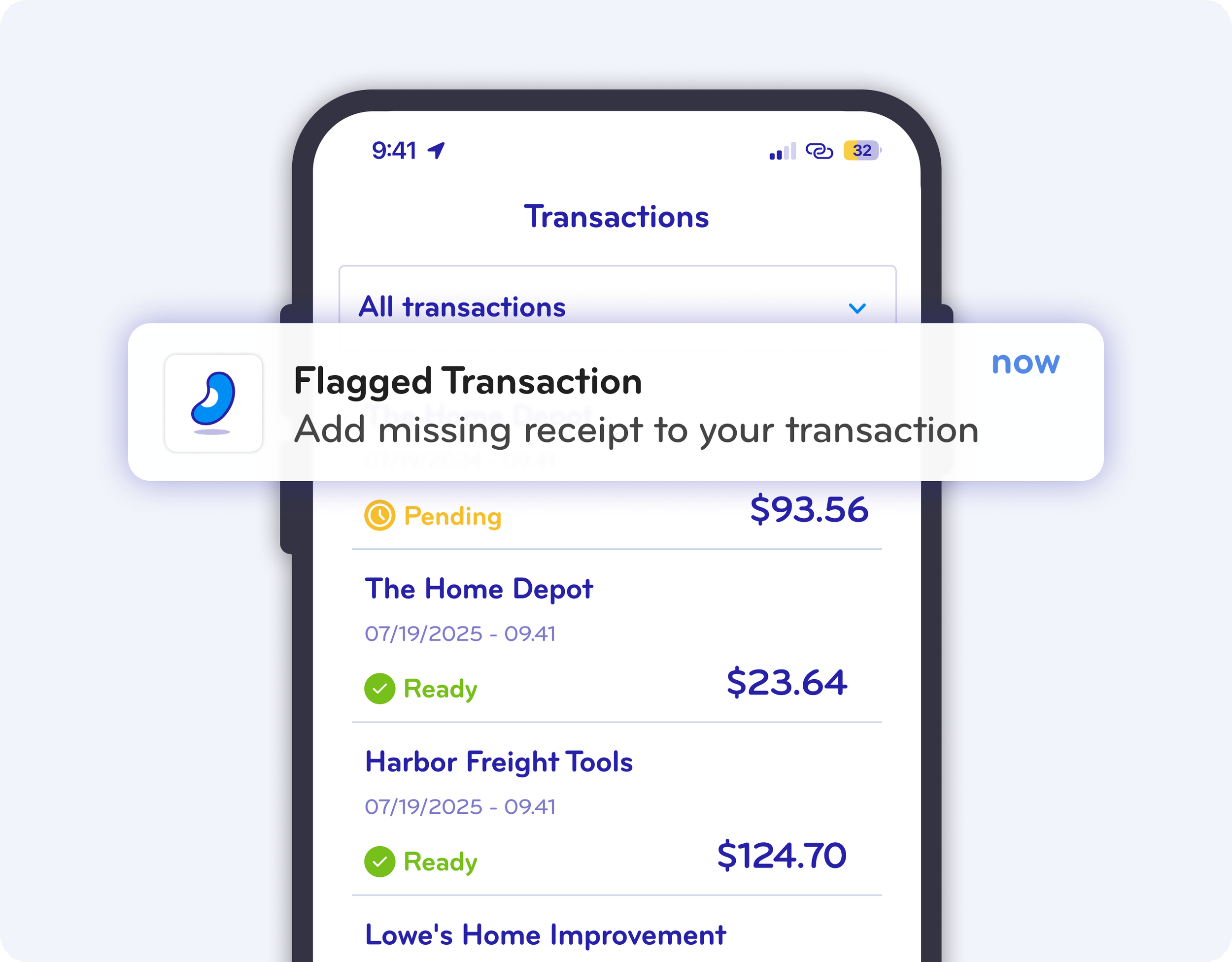

Smart Flags and Automated Follow-Up

BlueBean automatically identifies missing receipts, incorrect coding, or policy deviations.

Flags fire instantly

Employees are automatically notified

Corrections happen without manual Finance intervention

Your team stays in control without becoming the “spend police.”

Seamless Integration with Your Accounting System

BlueBean connects directly to your accounting software so that clean, enriched, fully coded data flows in automatically.

This means:

No manual data entry

No error-prone reconciliation

A dramatically faster month-end close

Consistent, controlled financial records

BlueBean supports integrations for small and mid-size companies as well as high-growth finance teams.

What BlueBean Delivers for Finance & Accounting

Expense Management

Tap-to-pay virtual cards through employees’ digital wallets

Instant receipt capture

Policy-based pre-spend controls

Automated expense reporting (zero manual work)

Tail Spend

A single platform to eliminate vendor sprawl

Controlled ad-hoc purchases without adding suppliers

Digital payments (via American Express virtual cards)

Automated coding, documentation, and reporting

Procure-to-Pay

Browser-extension-based purchasing

Virtual cards issued only after requests are approved

No more small invoices to process manually

Automated data capture and accounting sync

Transform Finance Operations with BlueBean

When Finance teams automate spend at the source, the entire company operates more efficiently.

No more chasing. No more errors. No more manual admin.

Just clean data, real-time visibility, and effortless control.

Ready to Eliminate Manual Finance Work?

See how BlueBean automates your end-to-end spend process.

Try BlueBean with your team and experience instant time savings.