Turn Tail Spend from an Expense Line into a Cashback Channel — Automatically

Tail spend doesn’t have to be a black box of small purchases, policy violations, and wasted hours. With BlueBean, every low-value purchase becomes controlled, visible, automated, and profitable—powered by AI, enriched by real-time data, and funded by cashback on every approved transaction.

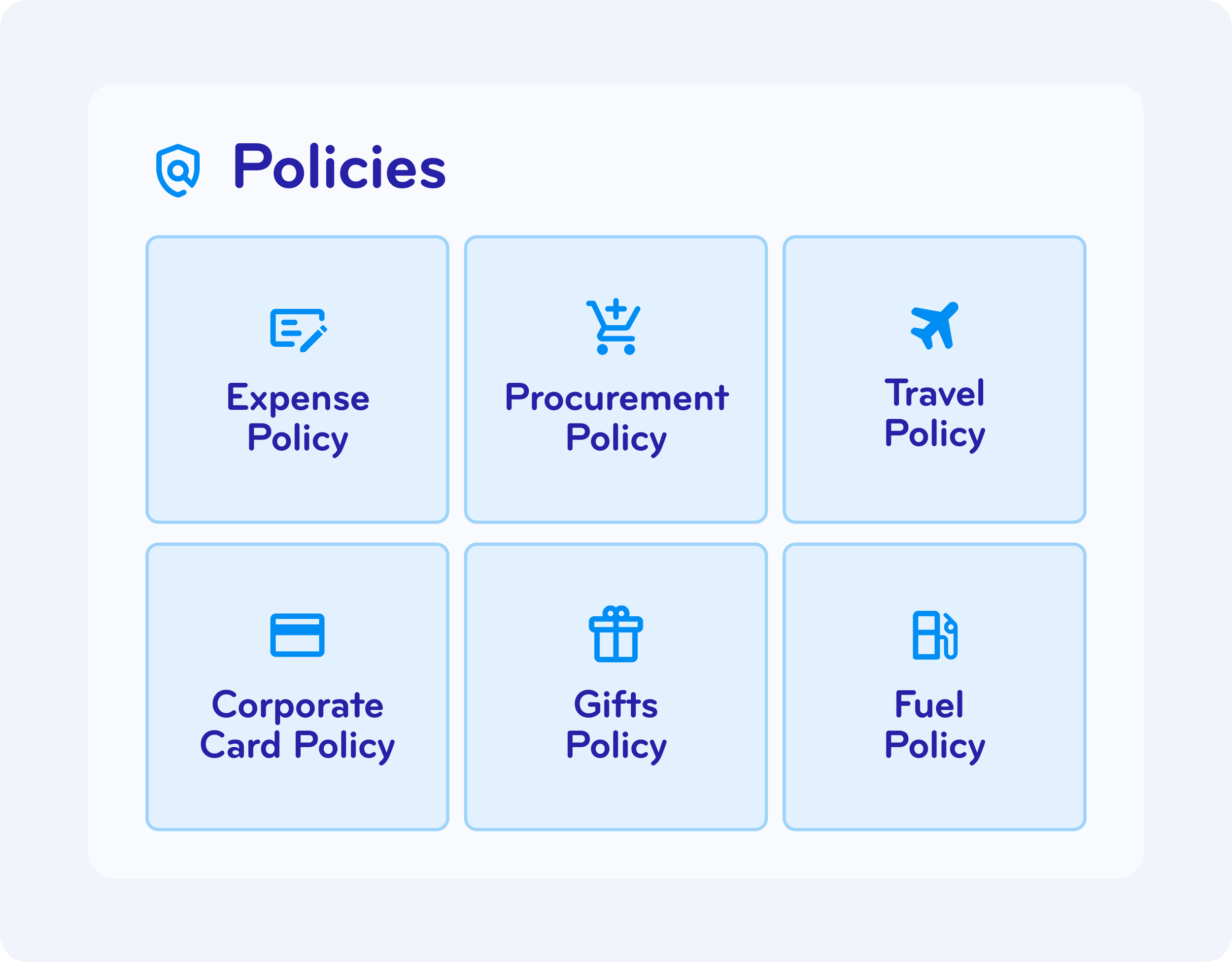

Control Tail Spend Before It Happens — With AI-Guided Buying and Real-Time Policies

Most tail spend solutions rely on self-reported surveys: users say their purchase “follows policy,” and the system simply trusts them. That means zero real-time enforcement, zero source-of-truth verification, and plenty of leakage.

BlueBean flips the model.

Our AI checks every purchase at the exact moment of transaction—verifying supplier legitimacy, price fairness, category alignment, and internal policy compliance automatically. No surveys. No loopholes. No blind approvals.

The result: low-value purchases stay fast for employees, but fully controlled for finance, procurement, and IT.

Gain Complete Visibility and Insights on Every Purchase

Traditional tail spend tools show spend after the fact—after the money is gone, after the policy is violated, and after the reporting period ends.

With BlueBean, visibility is instant.

Access real-time dashboards of every transaction

View itemized breakdowns (not opaque totals)

Detect patterns and anomalies as they happen

Tag, categorize, and track spend across teams and vendors automatically

Transparency isn’t a monthly report. It’s live, every second.

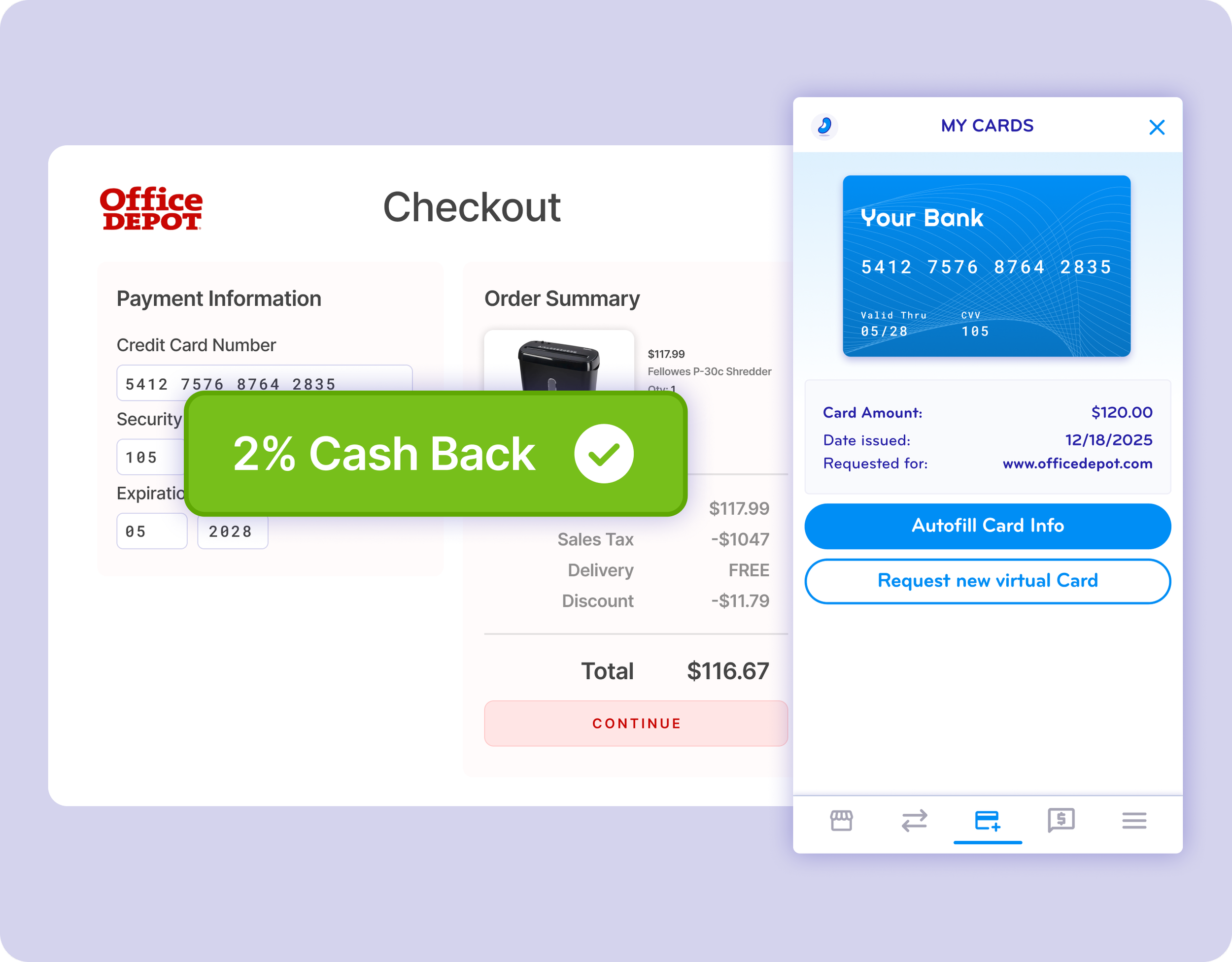

Earn Cashback on Every Dollar Spent — and Turn Spend into Revenue

Other tail spend platforms stack fees on top of your spend—sometimes charging 2–5% for every “managed” transaction. BlueBean works differently.

Because purchases run on virtual cards issued through our bank partners, companies earn an average of 2% cashback on approved spend—automatically.

That means:

Savings instead of fees

Concrete ROI from day one

Tail spend transformed into a profit generator

BlueBean doesn’t cost extra.

BlueBean pays you back.

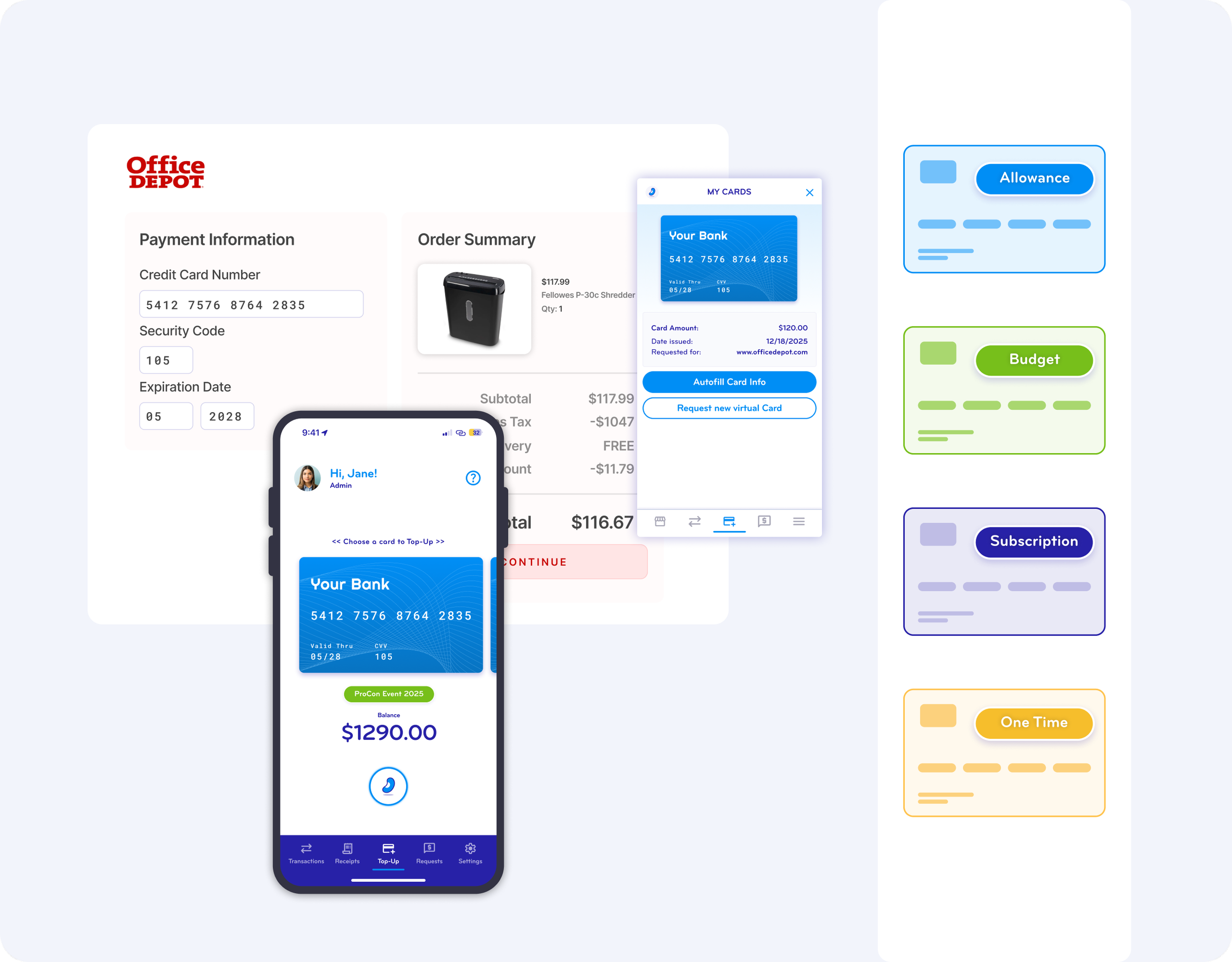

Simplify Low-Value Purchases Without Losing Control

BlueBean makes it effortless for employees to purchase the small things they need—without the friction of POs, forms, or manual approval chains.

Guided buying reduces back-and-forth

Employees receive instant, policy-aligned virtual cards

Accounting entries and receipts are automated

Fraud and waste are eliminated through real-time checks

Finance stays in full control of budget caps, categories, and vendor rules

You get speed without risk—and compliance without manual work.

Scale from Tail Spend to Total Spend Management

Start with tail spend. Grow to complete online spend management—same platform, same controls, no re-implementation.

BlueBean scales with your organization:

Tail spend automation

Non-PO online purchasing

Subscription management

Expense management with employee wallet cards

Full spend visibility across procurement and finance

One platform. One workflow. One source of truth.

What is tail spend and why it matters for finance teams

Tail spend refers to the high volume of low-value purchases that fall outside negotiated contracts and strategic sourcing programs. While individually small, these transactions typically represent the majority of purchasing activity and account for a disproportionate share of accounting workload.

With BlueBean, tail spend is managed at the point of purchase using card-native payments with embedded controls. Every transaction is approved before spending, paid immediately, and captured automatically — eliminating invoices, manual validations, and after-the-fact reconciliation for finance and procurement teams.

How BlueBean transforms tail spend compared to traditional solutions

Traditional tail spend solutions focus on processing transactions through intermediated marketplaces or supplier networks and often charge transaction fees that increase costs as spending grows. These models may reduce sourcing effort but continue to generate invoices and accounting work.

BlueBean takes a fundamentally different approach by using card-native payments for tail spend. Purchases are made directly with suppliers, paid instantly, and captured automatically. Instead of paying transaction fees, organizations benefit from card rebates — turning tail spend from a cost center into a source of financial return while dramatically reducing accounting volume.

When BlueBean is the right solution for managing tail spend

BlueBean is ideal for organizations looking to control tail spend without increasing operational overhead. It is particularly effective when procurement teams want to reduce manual sourcing and approvals, and when finance teams want to eliminate invoice processing for low-value, high-volume purchases.

Companies benefit most when they want real-time visibility, enforced policies, and automated accounting for every tail spend transaction. By combining guided buying, embedded controls, and card rebates, BlueBean allows organizations to scale tail spend management from SMBs to enterprises while improving productivity and financial outcomes.

FAQ

-

Tail spend is the large volume of small, low-value purchases that sit outside normal procurement processes.

They’re typically spread across many employees, many suppliers, and many categories, making them:hard to control

hard to analyze

and very expensive to process manually

Even though each transaction is small, tail spend often represents a big share of total purchasing activity and a disproportionate share of operational effort.

-

BlueBean applies real-time financial, policy, and supplier controls at checkout.

Before a card is issued, every tail spend request is checked for:budget availability

financial authority

supplier rules

policy compliance

Compliant purchases are approved automatically. Non-compliant ones are blocked or routed for approval. This turns tail spend from “unmanageable noise” into controlled, rule-based purchasing.

-

No.

BlueBean does not require supplier onboarding, marketplaces, or portals.

Employees shop directly on the suppliers’ websites, while BlueBean:guides them to preferred suppliers

applies rules to any other supplier

issues virtual cards only when the purchase passes controls

You get tail spend control without changing how suppliers operate.

-

Every transaction is captured the moment it happens, including supplier, amount, category, user, and decision outcome.

BlueBean’s analytics give you:granular visibility across suppliers, teams, and categories

insight into which purchases are approved, blocked, or require exceptions

a clear picture of tail spend patterns that were previously invisible

You can finally see tail spend clearly and act on it.

-

Traditional tail spend solutions often charge transaction fees on every purchase.

BlueBean instead uses virtual-card-native payments that can generate rebates on eligible spend.The result:

no extra fees per transaction

rebates on the volume you run through BlueBean

the ability to turn a cost-heavy spend category into a cashback channel

The more tail spend you route through BlueBean, the more financial upside you create.

-

BlueBean doesn’t break — it escalates.

If an employee needs to buy from a non-preferred or new supplier:the request is flagged

all context is presented to an approver

the approver can approve/deny with one click

This keeps you flexible while still maintaining strong control.

-

Yes — significantly for both.

For procurement, BlueBean eliminates:

after-the-fact policing of tail spend

reviewing non-compliant invoices

investigating unknown vendors

handling off-contract purchases by hand

onboarding suppliers just for one-off buys

For finance, tail spend is often up to 80% of accounting volume. BlueBean removes that burden by converting tail spend into:

controlled, virtual-card-native transactions

automatic receipt capture

automatic coding to the right accounts and cost centers

real-time budget enforcement

clean, enriched data ready for posting

This dramatically reduces manual invoice processing, GL corrections, receipt chasing, and end-of-month reconciliation work.

-

Yes.

BlueBean’s control model scales from a small organization to a large enterprise. You can enforce the same tail spend rules across:teams and departments

projects and cost centers

multiple locations

Everyone follows the same smart guardrails automatically, without extra training.