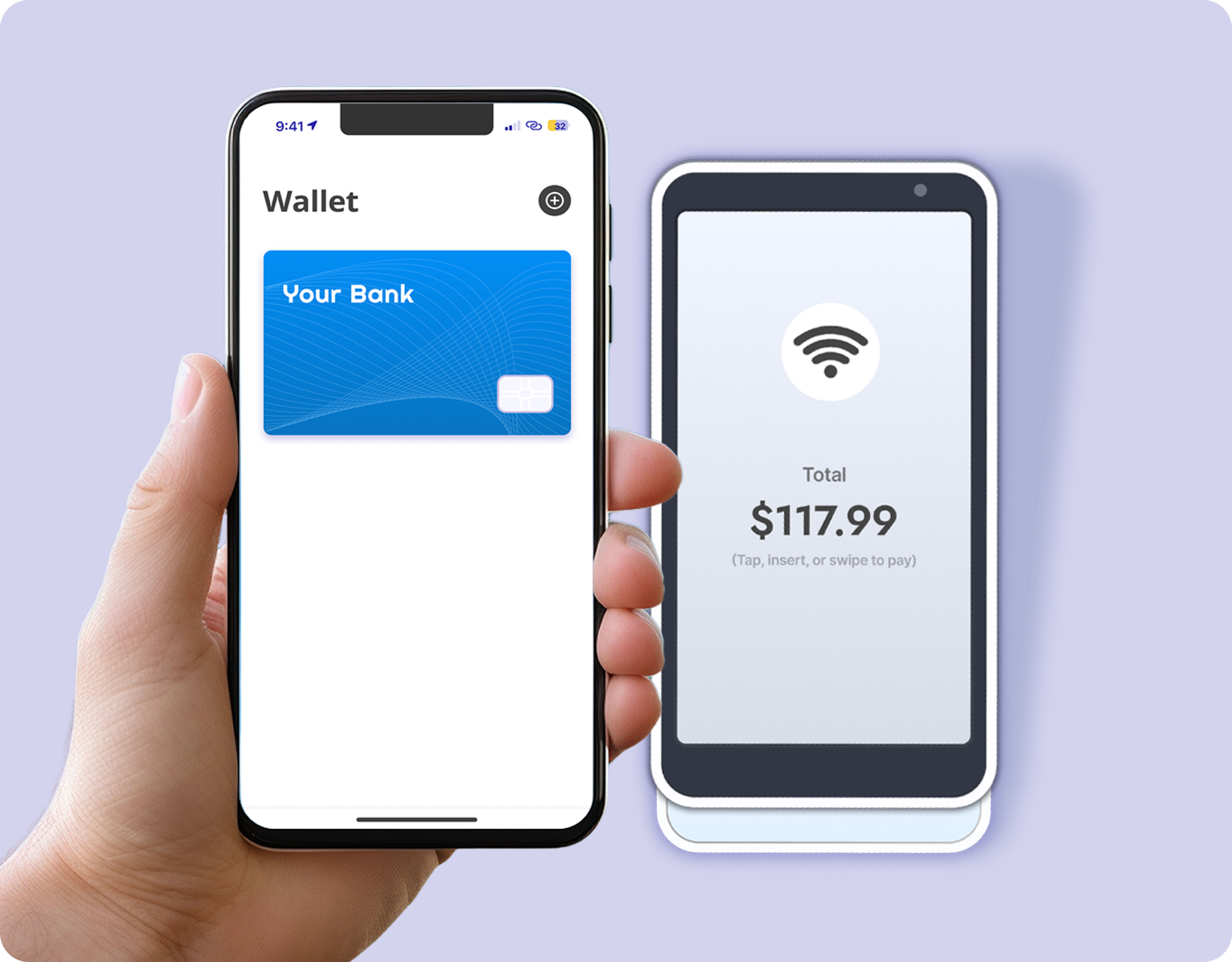

The Most Secure Cards in Your Wallet – Tap-to-Pay for Business, Reinvented

Turn in-store business purchases into automated, policy-compliant, receipt-capturing transactions—with virtual cards built natively for mobile wallets. BlueBean transforms every tap-to-pay moment into a controlled, secure, and fully accounted-for business payment.

Ready to Reinvent In-Store Business Payments?

Put the most secure virtual cards in your team’s mobile wallets.

Virtual-Card-Native Payments for Tap-to-Pay Transactions

Unlike legacy corporate cards retrofitted for mobile, BlueBean’s virtual cards are designed from the ground up for digital-first usage.

Every card exists natively in the employee’s mobile wallet, ready for tap-to-pay anywhere American Express is accepted.

With every purchase you get:

Instant spend validation

Real-time transaction classification

Automatic receipt capture via mobile notification

Zero dependency on plastic cards or manual uploads

Your team pays in seconds. You stay in control in real time.

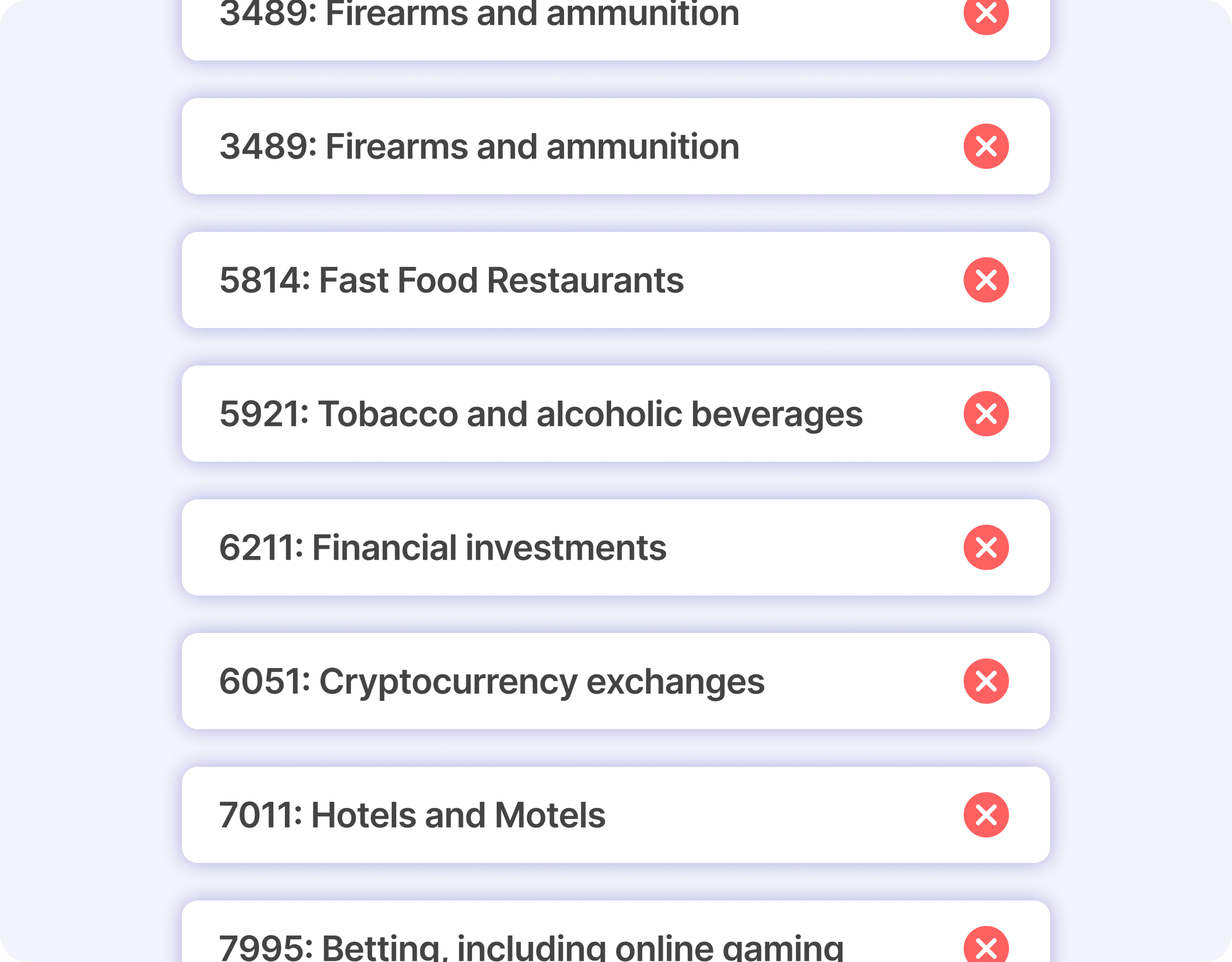

Embedded Controls for Real-Time Spend and Policy Compliance

BlueBean brings the same advanced controls available in online procurement to in-store mobile payments—without slowing employees down.

Merchant Category Controls (MCC Controls)

Restrict card usage to approved merchant types and protect against unauthorized in-store spend. MCC controls can be:

Set globally on the user profile

Customized at the individual card level for temporary use cases or exceptions

Combined with amount limits, approval paths, and dynamic card rules, BlueBean ensures every tap stays aligned with company policy.

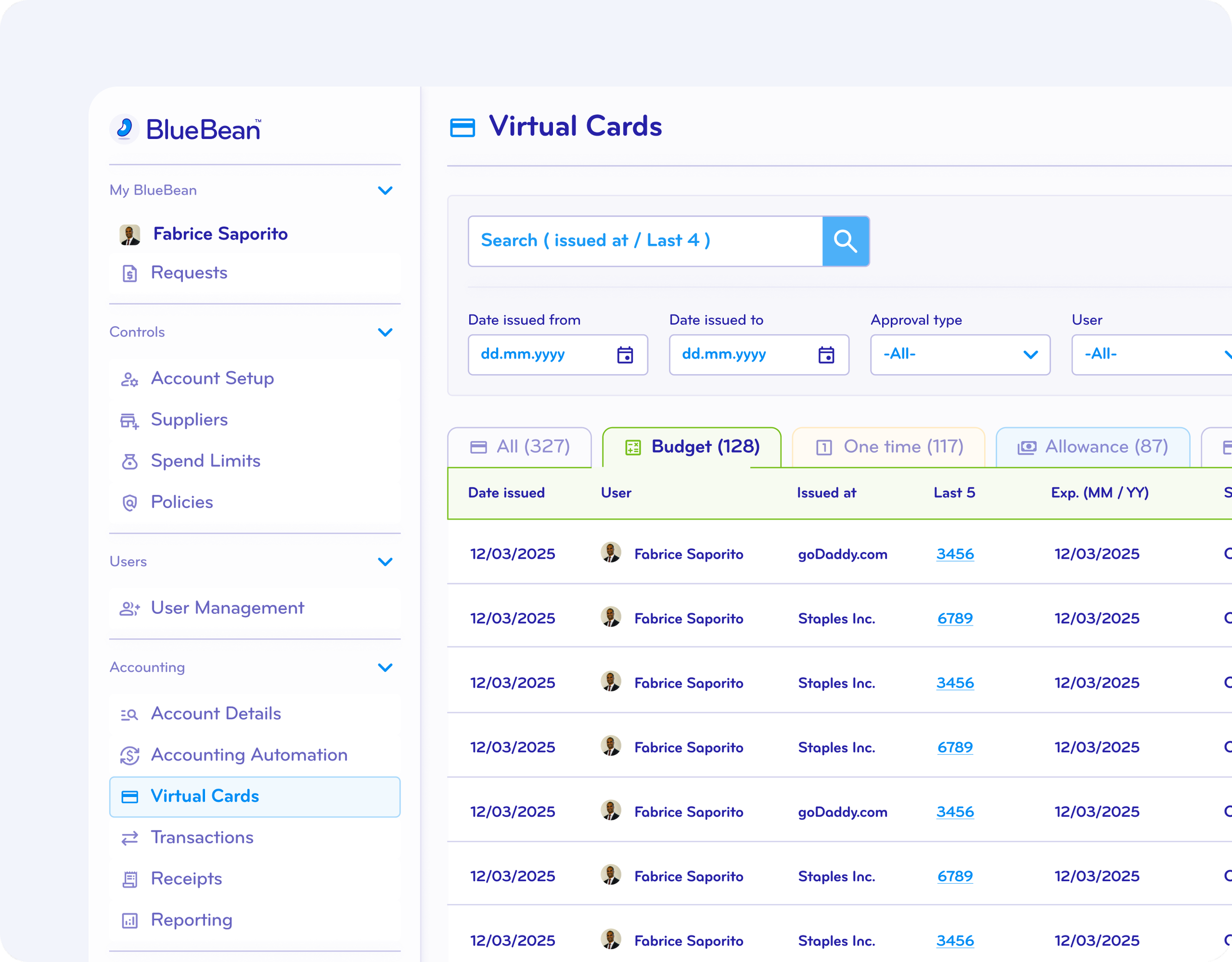

Cards Designed Specifically for In-Store Business Purchases

Not all in-store purchases are alike—and your controls shouldn’t be either. BlueBean offers two purpose-built virtual card types for mobile wallet payments:

1. Allowance Cards – Maximum Control for In-Person Payments

Ideal for organizations that manage tight spend boundaries.

A user requests a top-up for each purchase

If the amount exceeds the pre-set allowance, an approval is required

After the transaction—regardless of remaining balance—the card automatically resets to zero

This model gives finance teams full oversight while enabling employees to make purchases as needed, with zero risk of lingering funds.

2. Mobile Budget Cards – Perfect for Events, Projects & Recurring Needs

Flexible virtual cards tailored to real business workflows.

Create cards with event-specific or recurring budgets

Ideal for trade shows, field operations, office runs, and operational categories

Funds remain available as defined by your budget rules, without requiring per-transaction top-ups

Allowance cards maximize control. Mobile budget cards maximize flexibility. Together, they cover every in-store spend scenario.

Control Every Tap, Without Slowing Down Your Team

See how allowance cards and mobile budget cards give you complete oversight of in-store spending.

Digital-Native Transactions with Built-In Security and Control

Because BlueBean’s cards live entirely in the digital ecosystem, they come with stronger protection than traditional plastic cards:

Tokenized tap-to-pay transactions

Dynamic card numbers that limit exposure to fraud

Instant card freeze/unfreeze from the BlueBean app

Automatic receipt capture to eliminate missing documentation

Real-time accounting automation to ensure every purchase is correctly coded

Security isn’t an add-on—it’s embedded directly into every payment.

Upgrade Your In-Store Spend Management

Eliminate fraud, automate accounting, and ensure policy compliance from the moment of payment.